22nd March 2013, By Eng Parakrama Jayasinghe

From written submission to

Public Utilities Commission of Sri Lanka

in reference to the call for public comments on the proposed consumer

tariff to be applied form the 1st of April 2013. The author, Eng

Parakrama Jayasinghe, is the Hony. President of

Bio Energy Association of Sri Lanka, a Member of the Board of Directors –

Sustainable Energy Authority, and a Member of the Board of Directors –

NERD Centre.

Preliminary

Achieving a stable and sustainable energy supply, as well as a tariff structure affordable to all segments of consumers requires a long term vision and strategies, applied year by year on a consistent basis.

Subsidies provided for maintaining a generation mix dominated by imported oil or coal is non sustainable and such subsides will only flow to the pockets of the oil and coal suppliers. The deficit run by the

CEB is made good by the treasury which means that the supposedly low electricity bill is a myth.

Therefore the only lasting solution is to move towards a generation mix which is by far dominated by indigenous sources of energy as was the case prior to 1995, when 95 % of the generation was from major hydro. The tariff proposals should therefore have this long term goal and everyone must be ready to pay that extra amount now, to overcome the sad situation, created due to lack of proper vision in the past decades, so that we can move towards a more rational and secure energy system. Until such a situation is achieved it is to the advantage of both the CEB and the country to reduce the generation using fossil fuels either by CEB or the IPPs as much as possible.

Recommendations

- The tariff system should be designed to promote maximizing the indigenous sources. The true cost of generation using oil or coal must be calculated without direct or indirect subsidies and state facilitation provided for such generation. Thus any subsidies given to the consumer is a conscious decision based on the true costs. Since such subsidies are not sustainable in the long run, this would encourage self generation by the high end consumers, thus lowering the burden on the CEB and the treasury.

- The problem of managing the peak load is not addressed. The time of day metering facility should be extended on optional basis to the domestic consumers with a demand of over 180 units per month and for the General Purpose GP 1 and Hotels HP 1 consumers. The price per unit during the peak hours should also be the true cost of the fossil fuel based generation, as the lower end users needs could have been met from the lower cost sources such as hydro already in place.

- The tariff for the high end users should also be cost reflective. They must be encouraged to use indigenous sources and install self generation to meet at least part of their requirements. This too will reduce the burden on the CEB and will be a means by which the consumers can reduce their electricity cost.

Back Ground for the Recommendations

The CEB is continuing to make losses due to

- High Cost of Generation quoted as Rs 20.84 per KWh, average , but is likely to be much higher. The low cost of the major hydro capital cost of which have been paid up many years ago is the reason that the average unit cost is so low.

- Sale of electricity at rates lower than the cost

This is not a sustainable situation and has to be arrested sooner than later. The deficit is covered by public funds. Therefore it is a fallacy to pretend that any of the consumers are receiving “cheap “ electricity. The burden of funding the deficit is carried by all Sri Lankans, now that we are nearly 100% grid connected, irrespective of the level of consumption.

Thus all Sri Lankans should be ready to accept the burden of an increase in the tariff, provided that plans are in place for a more sustainable future.

Although the proportional increase of tariff for the lower end consumers has been portrayed as high percentage ( 59%) increase, even the increased tariff at Rs 6.25 (Rs. 5.00 per unit with the fuel adjustment of 25% ) is less than 25% of the current average cost of generation of Rs 20.84 Similar situations has existed for many years. The current increase to be paid is only about Rs 200.00 per month, far less than the amount paid for such luxuries as mobile phones. The CEB has quite correctly extended the grid to nearly 100 % at costs far in excess of the returns that could be expected. This is a subsidy that is fair and proper so that all Sri Lankans are given access to electricity.

It is however not correct for the consumers to expect the energy at prices far less than the cost of generation.

Thus each unit consumed by this segment carries a subsidy of Rs 20.84-6.25 = Rs 14.59

Since the predicted generation mix is 50% thermal based on fossil fuels, this subsidy is in fact a means of subsidizing the suppliers of oil and coal and not the Sri Lankans at any level. This will worsen in the years to come with the contribution by fossil fuels increasing to over 75% as per the current long term generation plans.

Thus there has to be a concerted effort to change the generation mix to maximize the uses of hydro and other indigenous sources of energy. While this cannot be achieved in a year, the tariff policy in the current year and the years to come must be consistently designed to encourage this change continuously.

Contrary to the popular myth, the cost of indigenous energy is cheaper than that of coal power, touted as the cheapest source and promoted aggressively by the CEB, quoting totally erroneous figures and hiding the important elements of cost in coal power generation. The table below of the fuel costs alone for power generation using different fuels illustrates this fact.

• Diesel 0.28l/kWh @ Rs 117.00/l Rs 32.76

• Residual Oil 0.231 l/kWh @ Rs 67.00/l Rs 15.41

• Coal 0.39 kg/kWh @ Rs 17.92/kg Rs 6.98

• SRC Wood 1.0 kg/kWh @ Rs 4.50/kg Rs 4.50

• Agro waste 2.0 kg/kWh @ Rs 2.50 /kg Rs 5.00

Applying similar conditions , the balance costs on capital, O& M etc has to be similar for both coal and Wood, leading to a decidedly lower cost of generation using SRC wood.

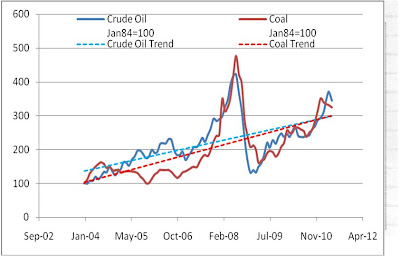

The world price trends and the continually depreciating rupee pressured by the huge import bill on oil and coal will make this difference wider in the years to come.

This fact has been demonstrated by the use of the WASP program used by the CEB for the determination of the least cost long term generation plan. Dendro has been included as the only source of firm energy from renewable sources, accepted by the CEB as a candidate.

However the outcome of this analysis which clearly indicated Dendro as the least cost option, was newer published.

The cost of generation using Solar PV is coming down year by year.

Thus the only way the tariff can come down or at least be maintained at present levels is by changing the generation mix.

Also since the CEB appears to have no solution other than fossil fuels to meet the future demands which will drive the percentage contribution by indigenous sources even further, the change may have to come from investments on generation by others, mainly the private sector through NCRE.

The problem of the daily peak load

The long term generation plan of CEB is promoting large scale development of coal power plants. This is done only to be able to serve the peak load between 6.30 PM – 10.30 PM , as even the current installed capacity is adequate to meet the average day time demand for many years to come.

However, the current generation strategy discourages using the abundant solar energy , and perhaps even the wind resource, whichever is available during the off peak hours. The need to operate the coal power plants at near full capacity, even during the off peak hours, acts as a deterrent for the development of the indigenous and potentially cheaper sources. The lack of interest in promoting the “net metering” concept is evidence of this.

However, there could be many individuals and organizations who would be willing to install self generation facilities, even using such non firm sources , to reduce the burden on the CEB to cater to the high demand over a few hours on a daily basis.

Therefore in order to promote such self generation and also to encourage use of such capacity , primarily during the peak hours, it is proposed that the time of day metering facility be made available to the domestic consumers who consume over 180 units per month and to the G P 1 and HP 1 categories of consumers.

This can be made optional at the beginning and made mandatory in the coming years.

A typical installation would be a 2 kW solar PV domestic installation with adequate battery storage to cater to the four hours of peak . The cost of such an installation could be recovered in less than four years based on current world market prices of PV systems.

The potential saving of the peak load capacity that needs to be provided by the CEB would be in the order of 500 MW by this change, by a fraction of domestic consumers alone. The details of this calculation can be provided.

Self Generation by large Consumers

The CEB statistics indicate that 11% of the consumers are responsible for 60% of the total demand for electricity.

This is a potential segment where self generation could be promoted even during the off peak hours. In the past CEB was in the habit of calling on such consumers to use their diesel generators during the dry months with incentive payments. There is no reason why this promotion should not be continued, as there are indigenous sources with the potential for generation at much lower costs. The difficulties faced by the CEB and the government in finding the capital for adding new generation capacity can also be overcome by this means. The proposed tariff structure should provide incentives for such consumers to move in this direction.

Related Info :

•

Sri Lanka Should Reduce Peak Power Demand and Trim Most Expensive 5pct of Energy to Eliminate Losses at CEB - LirneAsia, a Regional Think Tank

•

Sri Lanka's Power Monopoly Draws Fire at Public Hearing on Proposed Tariff Hike. Costs Claimed by CEB are Murky and Efficiencies of Plants are not Independently Audited

•

Electricity Tariff Hike - Industries Get Biggest Subsidy, Hotels Marginally Subsidized & General Purpose Customers to Pay in Excess of Costs - an Analysis by the Regulator

08th April 2013,By Eng Parakrama Jayasinghe

08th April 2013,By Eng Parakrama Jayasinghe